The Monetary Policy Committee (MPC) of the Bank of Ghana (BoG) has increased the Monetary Policy Rate by 150 basis points to 29.5 percent.

The prime rate, which is of keen interest to businesses, signals the rate at which the Central Bank will lend to commercial banks.

It also subsequently influences average lending rates on loans to individuals and businesses.

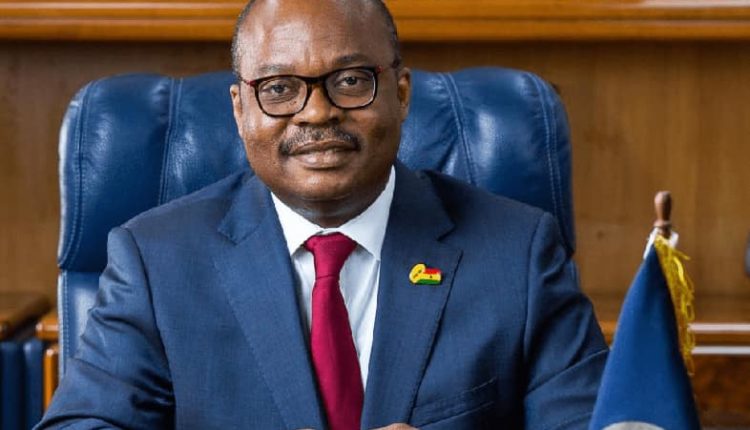

In his address to the media, Governor of the Central Bank, Dr. Ernest Addison, cited likely risks to the country’s inflation outlook despite the recent moderation and deceleration of inflationary pressures and the marginal stabilisation of the local currency.

“This will be critical in resetting the economy on the path of recovery and sustaining growth. Headline inflation has declined marginally for two consecutive months, but continues to remain relatively high compared to the medium-term target of 8±2 percent.

To place the economy firmly on the path of stability and reinforce the pace of disinflation, it is important that the monetary policy stance be tuned further to re-anchor inflation expectations towards the medium-term target. Given these considerations, the MPC decided to increase the Monetary Policy Rate by 150 basis points to 29.5 percent.”

The increase in the policy rate means the cost of credit will continue to remain high, affecting household spending and private sector growth.

Latest data from the Bank of Ghana’s Summary of Macroeconomic and Financial Data for March 2023 indicates that average lending rates shot up marginally to 36.64% in February 2023, from 35.58% recorded in December 2022. This is equivalent to 3.02% interest rate on loans per month.

Dr. Ernest Addison also noted that the recent Domestic Debt Exchange Programme (DDEP) has impacted negatively on banks, hence the need for the Central Bank to make necessary adjustments to its regulatory requirements to support the banks.

“Whiles the domestic economy still faces relatively tight global financing conditions and heightened uncertainty about the global economic outlook, the effects of these could be amplified inherent vulnerabilities including structural and excess liquidity following the DDEP and the widening negative outlook gap”.

He, however, stated that based on its recent stress test, the banks remain strong, sound and stable.

Comments are closed.