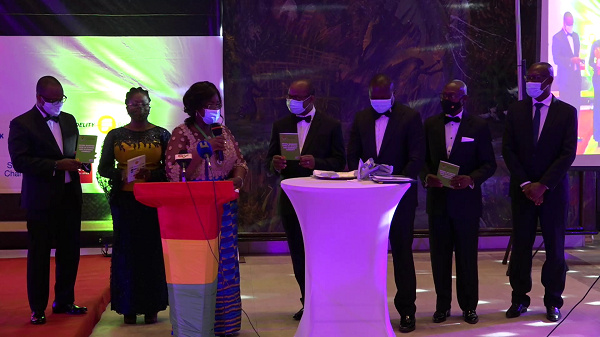

The Chartered Institute of Bankers, Ghana (CIB) in collaboration with the Bank of Ghana (BoG) and the Ghana Association of Bankers (GBA) has launched the Ghana Banking Code of Ethics and Business Conduct.

This forms part of efforts to reduce the number of fraud cases perpetrated by employees within the banking industry.

Speaking at the launch of the Ghana Banking Code of Ethics and Business Conduct, President of the Chartered Institute of Bankers, Patricia Sappor stated that the Code is intended to guide all practitioners to maintain the best banking practices and strong commitment to sound ethical and professional standards in the banking industry.

“The launch of this Code is a timely and relevant milestone in the banking industry as it will serve as the bedrock and a guide to all practitioners to maintain best banking practices and strong commitment to sound ethical and professional standards in the banking industry. This will ensure that Chartered Bankers continue to play critical roles in the banking industry and distinguish themselves on account of the significant contributions they make to the profession of banking as it is the only qualification customized to the core practice of banking,” she said.

She also noted that employees within the financial sector who fail to conduct their duties fairly, honestly and with integrity will be dealt severely by the law as the entire banking community risks losing confidence amongst customers and the general public.

“The Code reinforces provisions made under Sections 18 (2) (d), 24 (1) (a) and the Third Schedule of Act 991. Thus, ensuring that all Financial Institution employees conduct their duties fairly, honestly and with integrity so as to uphold the mutual trust and public confidence bestowed upon them. The effective implementation of the Code will foster high level of integrity, discipline and etiquette in the banks leading to improved confidence amongst customers and the general public,” she added.

It will be recalled that the Bank of Ghana in its 2019 Banking Industry Fraud Report stated that, out of the total number of 2,295 fraud cases reported in 2019, suppression of cash and deposits accounted for the largest portion, that is 77 percent, with staff of the financial institutions being the lead perpetrators of that type of fraud.

The Code is in line with Section 3 (d) of the Chartered Institute of Bankers Ghana Act, 2019 (Act 991) which reinforces the Institute’s mandate of setting standards and ensuring the observance of ethical standards and professional conduct amongst members of the banking profession in the country.

Comments are closed.