The government has made a successful debut in the international debt capital markets securing US$3 billion from an oversubscribed bond book value of US$6 billion.

Ghana becomes the first Sub Saharan African sovereign to issue a Eurobond in USD since the onset of the COVID-19 pandemic.

The country’s consistent ability to raise multi-billion-dollar financing and this pioneering use of a 4-Year Zero tranche is a testament to its hard-won credibility with investors, strong growth prospects and disciplined fiscal consolidation efforts in 2020, a statement from the Finance Ministry said.

“Ghana is the first emerging market sovereign to add a zero-coupon bullet tranche to its bond financing portfolio. This is significant as it enables the government to create fiscal space to build the economy back better,” the statement added.

Commenting on the bond, Ken Ofori-Atta, Minister for Finance-designate said, “This historic bond issuance is a strong signal that investors have confidence in our plan for debt sustainability, economic recovery and growth and that Ghana remains a ‘Pillar of Stability.’

This bond issuance comes after a series of fixed-income virtual meetings held locally in three days with investors from the United States, United Kingdom, Europe, Middle East and Asia.

The transaction comprised US$525 million 4-year zero-coupon, US$1 billion 7-year weighted average life (WAL), US$1 billion 12-year WAL and US$500 million 20-year WAL. The traditional Eurobonds priced at 7.75%, 8.625% and 8.875%, respectively.

Ghana’s four-year zero-coupon bond is an innovative market-oriented solution to address post-COVID-19 challenges and improve the cash flow required for debt servicing.

It was twice oversubscribed, despite being the first of its kind to be issued by an emerging market sovereign, further demonstrating investors continued support for Ghana’s transformation story and strong fiscal consolidation efforts.

Part of the proceeds shall be used for domestic liability management. “For example, using US$400m of the zero-coupon bond to refinance domestic debt with an average interest rate of 19% will net Ghana savings of some $200 million over the next four years,” Ofori-Atta said.

The 20-year tranche, which priced at 8.875% is also expected to fill a gap in Ghana’s yield curve, ensuring that Ghana now has a well-defined yield curve with issuances across the curve from 4 years to 41 years.

Ghana is projected to maintain positive economic growth of 0.9% in 2020, representing one of the few “pockets of resilience” on the continent.

In 2021 and over the medium term, the government expects GDP growth to average 5% and the deficit to decline to under 5% by 2024 ensuring debt sustainability. This will be achieved through the GHS100 billion Ghana CARES programme that will provide the fiscal stimulus to drive growth and economic transformation.

Also, the government has committed to implementing comprehensive measures including the introduction of e-taxation to increase domestic resource mobilization; the deployment of digital platforms to engage local communities in the oversight of public spending; and efforts to strengthen tax administration systems to identify, track and stem illicit financial flows (IFFs).

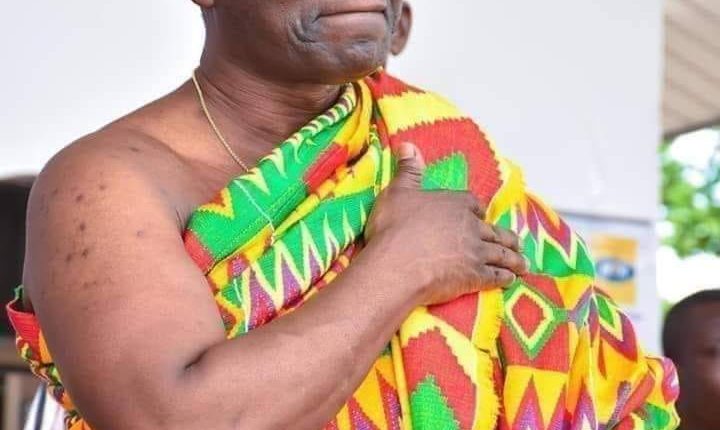

This reflects the exemplary leadership of the Nana Addo Dankwa Akufo-Addo led Government in handling the COVI-19 pandemic.

Ghana successfully raised US$2 billion in 2018, US$3 billion in 2019 and US$3 billion in 2020.

Monday’s (29 March) successful bond issuance is expected to boost business confidence as the government looks to stimulate the economy and increase revenue through what it calls “burden-sharing” for “enhanced profit-sharing.”

The joint lead managers for the transaction were BofA Securities, Citi, Rand Merchant Bank (RMB), Standard Bank and Standard Chartered Bank. They were supported by CalBank PLC, Databank, Fidelity Bank, IC Securities and Temple Investments as co-managers. -AsaaseRadio

Comments are closed.