The Ghana Stock Exchange (GSE) witnessed an unprecedented surge at the close of last week final weekday in trading volumes despite major stocks trading flat.

At the end of the day, 71,964,765 shares changed hands, translating to a staggering market value of GHS 92,831,130.30. This surge represents an astronomical increase of over 1000%, painting a picture of heightened activity within the exchange.

Intriguingly, despite the surge in trading volumes, the outcome for individual equities was a deadlock. All nine GSE-listed equities that participated in the trading session experienced neither gains nor losses.

This unusual equilibrium brings to light the complex dynamics at play in the Ghanaian stock market, where increased activity did not necessarily translate into individual successes or failures.

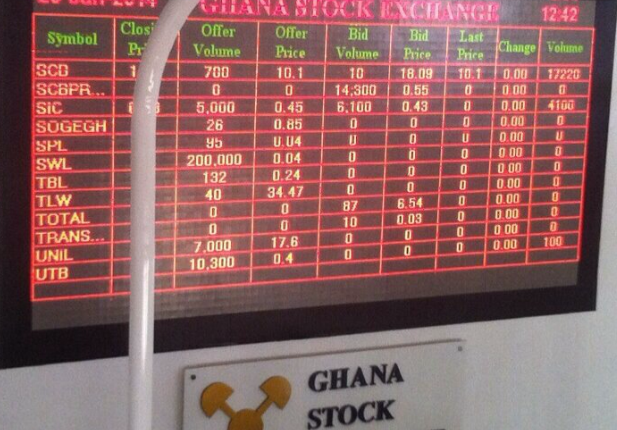

Taking center stage in this trading frenzy was MTN Ghana, which recorded the highest volume of traded shares at a staggering 72 million. Following closely were Ecobank Transnational with 10,002 shares, Benso Oil Palm Plantation with 200 shares, and Societe Generale Ghana with 100 shares. While these figures showcase the vibrancy of the market, the absence of gainers or losers hints at a delicate balance between buying and selling pressures.

Turning attention to the performance of the GSE market indices, the benchmark GSE Composite Index (GSE-CI) remained unscathed, closing at the same mark it opened at 3,195.62 points. This stability is notable, especially considering the heightened trading activity.

Moreover, the index reflects a 4-week gain of 2.24%, reinforcing a positive trend, and an impressive year-to-date gain of 30.76%, underscoring the resilience of the Ghanaian stock market amid global economic uncertainties.

GSE Index

In similar vein, the GSE Financial Stocks Index (GSE-FSI) mirrored the overall stability, maintaining its value at 2,042.09 points. This index displayed a 4-week gain of 3.17%, signaling a robust performance within the financial sector despite the lack of movement in individual equities. However, it also revealed a year-to-date loss of 0.51%, shedding light on the nuanced challenges faced by financial stocks in the Ghanaian market.

The absence of gainers and losers, coupled with the stability in market indices, prompts a closer examination of the factors influencing this unusual scenario. One plausible explanation could be a delicate equilibrium between supply and demand, where buying and selling pressures counteracted each other. This delicate balance might be attributed to a range of factors, including macroeconomic stability, investor sentiment, and possibly even external influences impacting global markets.

Furthermore, the standout performance of MTN Ghana in terms of traded volume suggests a keen interest from investors in the telecommunications sector. The telecom giant’s substantial contribution to the total trading volume indicates a sector-specific trend that merits closer scrutiny. It prompts questions about the factors driving investor confidence in telecom stocks and whether this interest will continue in the coming weeks.

The current market capitalization of the GSE now stands at an impressive GHS 74.5 billion.

The recent surge in trading volumes on the Ghana Stock Exchange has brought both excitement and stability to the market. The absence of gainers or losers, combined with steady index performance, showcases a unique snapshot of equilibrium in the face of heightened activity.

As investors await the unfolding of next week market dynamics, the Ghanaian stock exchange stands as a resilient entity, navigating the complexities of the global financial landscape with steadfast composure.

Comments are closed.