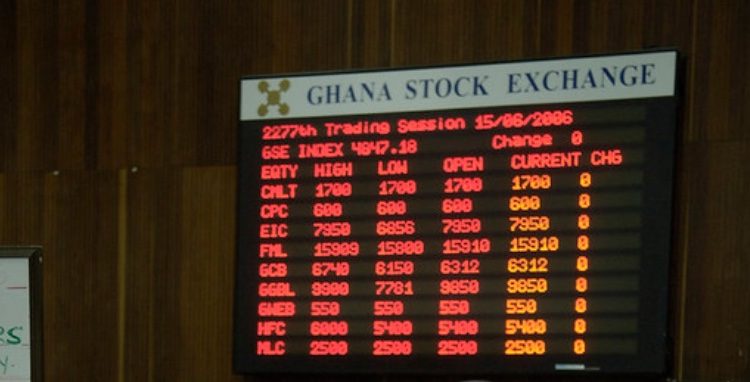

In the penultimate trading session on the Ghana Stock Exchange (GSE), a noticeable decline in trading activity has been observed.

A total of 3,223,842 shares were traded, amounting to a market value of GHS 6,783,846.54. This marked a significant decrease compared to the previous trading session on May 22, where both volume and turnover saw substantial reductions.

The data revealed a 69% drop in the volume of shares traded and a 66% decrease in turnover compared to the previous day’s figures. This sharp decline indicates a temporary slowdown in trading activities on the GSE, which could be attributed to various market dynamics and investor sentiments.

Despite this downturn in trading volume and turnover, the overall market capitalization of the Ghana Stock Exchange remains robust at GHS 83.9 billion. This figure underscores the resilience and underlying value of the equities listed on the exchange, even amidst fluctuating trading volumes.

During the penultimate trading session of the week, a total of 13 GSE-listed equities were active participants in the market.

Loses Again

Among the 13 equities that participated in the trading session, the NewGold ETF was the sole loser, closing at 336.00 GHS per share, a drop of GHS1.46 from its previous closing price of GHS337.46.

This slight decrease marks a 0.43% depreciation in its share price for the day. Interestingly, the NewGold ETF has been the standout performer on the GSE for the year, having started the year with a share price of 218.50 GHS. It has since surged by 53.8%, making it the top performer in terms of year-to-date gains.

This impressive growth highlights investor confidence in the ETF, despite the minor setback in the latest trading session.

MTN Ghana dominated the trading session with the highest volume of traded shares at 3.21 million. Other active participants included the Cocoa Processing Company with 6,000 shares, NewGold ETF with 2,972 shares, and Societe Generale Ghana with 2,860 shares.

The benchmark GSE Composite Index (GSE-CI) remained unchanged, closing at 3,751.07 points. This stability reflects a 1-week gain of 0.49%, a 4-week gain of 7.04%, and an impressive year-to-date gain of 19.83%.

The GSE Financial Stocks Index (GSE-FSI) also held steady at 2,049.94 points, marking a 1-week gain of 0.56%, a 4-week gain of 0.27%, and a year-to-date gain of 7.8%.

These Indices highlight the overall positive trajectory of the GSE, despite the recent dip in trading activity. Investors and market watchers will continue to monitor these trends closely, looking for signs of recovery or further fluctuations in trading volumes and market performance.

As the GSE moves forward, its ability to maintain strong market capitalization and positive index performance amidst fluctuating trading volumes will be critical to sustaining investor confidence and market stability.

The Ghana Stock Exchange continues to play crucial role for the investment sector a pivotal platform for investors, reflecting the economic activities and investment opportunities within Ghana.

While the recent decline in trading volume and turnover may raise concerns, the sustained market capitalization highlights the ongoing confidence in the listed equities.

As the GSE navigates through these fluctuations, market participants and observers will be keenly watching for any signs of recovery or further trends in trading activities.

Comments are closed.