A broke young Ghanaian practicing Muslim who recently won a cash amount of GHC6 million through gambling, has been ordered to reject and return the entire money to the betting company because his religious faith forbids gambling in all its shades and forms, including proceeds from gambling.

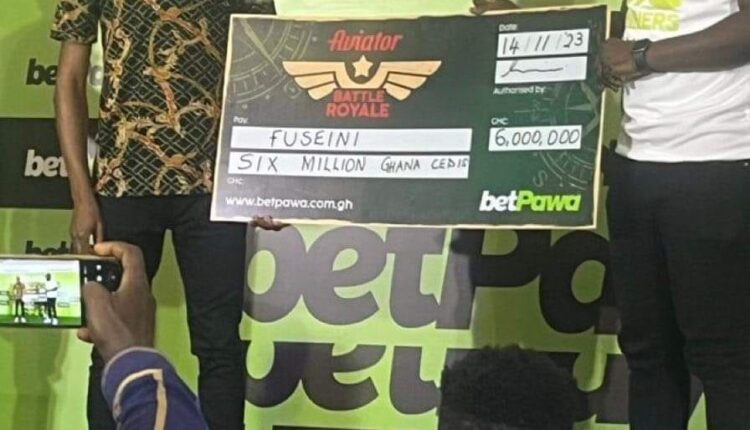

The winner only identified as Fuseini went to receive his cash amount with his mother, who was seen wearing a hijab and wiping tears of joy from the face of her son when he was presented with the a dummy cheque of their winnings on Tuesday November 14, 2023.

An emotional Fuseini who has over the years been yearning to turn the fortunes of his family, was seen shedding tears and being consoled by his mother and staff member of Pawabet, the platform on which the money was won

Despite Fuseini’s tears of joy over his GHC6 million win, some Islamic clerics have questioned the morality of the win describing it haram , a forbidden act, because it was money made through gambling.

Saunch Muslims view gambling as a sin or a practice not supported by Islam.

Some of the clerics have mounted pressure on the young man whose economic woes are now history to return the money.

The clerics urging Fuseini to return the gambling money have cited Quran 5:90 which says : “Believers! Intoxicants, games of chance, idolatrous sacrifices at altars, and divining arrows are all abominations, the handiwork of Satan. So turn wholly away from it that you may attain to true success…”

A social media platform Iqra Foundation that has taken on the winner and his mother wrote: “Fuseini has won GHC 6 Million (60 billion old currency) on Betting which we all know is haram. His mother with her veil is in the picture in support of her child’s haram. Betting has become a canker to the youth especially the Muslims and Zango youth in our communities so this Fuseini boy’s win will or it’s a motivation to some innocent children out there. What do you think?”

Social media has gone agog with split opinion as to whether Fuseini should return the amount in question or otherwise.

In August this year, Wins from lottery games, casinos and marketing promotional raffles started to attract a 10 per cent tax.

In addition, the Gross Gaming Revenue (GGR), which is the amount generated from all stakes less the winnings, has been subjected to 20 per cent withholding tax.

The Ghana Revenue Authority (GRA) is hoping to mobilise about GH¢1.2 billion in the initial stages of implementation of the taxation of lottery operators.

Revenue mobilisation from the taxes is expected to increase to about GH¢3 billion after the initial stages.

The move follows the passage of the Income Tax (Amendment) Act, 2023 (Act 1094), which subjects all lottery wins to the withholding tax, to be deducted by the lottery operators and paid to the GRA.

In line with the law, the withholding tax deduction applies to winnings paid by private lotto operators of sports betting, casino operators, route operations (slot machines), marketing promotions, national lotto betting, remote interactive games operators, and other games of chance.

Already calculations and some deductions are been made as to whether the 10% withholding tax put on betting by the government has been deducted.

Others have also converted the 6 million wining into the old cedis suggesting young Fuseini is 60 billion richer and now the latest billionaire in town.

Comments are closed.