Verifiable figures and data from the Social Security and National Insurance Trust (SSNIT) disprove baseless gossips that the Scheme would collapse and deplete its reserves within the next twelve years.

Rather, the figures indicate that SSNIT is raking in more contributions that it is paying out in pensions and also 95 percent of its investments across several sectors are making huge gains and paying dividends.

Gossips of an approaching collapse of SSNIT went viral after some politicians added a spin to reports of the 2017 to 2020 actuarial valuation by the Actuarial and Social Protection Unit of the International Labor Organization (ILO).

Whereas the valuation report was emphatic that the aim was to to find out whether the financing of SSNIT is on course over the long term and that due to the long-term nature of assumptions, absolute figures include a high degree of uncertainty, there has been a sustained propaganda in the media that the assumptions of a possible depletion of reserves in the future is a conclusive finding and there is no recommended solution to avert the possible fruition of that assumption.

Meanwhile, the same 2020 ILO actuarial report stated that “results should be interpreted carefully and future actuarial reviews should be undertaken on a regular basis to revise actuarial assumptions in light of the actual experience of the Scheme.”

The 2020 ILO actuarial report cannot and should not be read in isolation because in 2011, the ILO valuation, based on assumptions, had projected that has projected that from 2019 onwards and assuming there is no future increases in contribution rates the Reserve was projected to be exhausted during 2031.

Again in 2014 another ILO actuarial valuation report predicted that based on assumptions, in 2035, the total income by way of contributions, investment income and other inflows will no longer be sufficient to pay for annual expenditures, therefore the reserve would start to decrease, and by 2042, the reserve would drop to zero.

In each report, the independent actuary had made recommendations to avert the possible fruition of the assumption.

The general public has been urged to not panic because even if the assumptions are anything to go by, pensions are not paid primarily from reserves and SSNIT has continued to ensure prudent management of funds to enhance the long term sustainability of the Scheme, SSNIT, as part of measures to sustain the scheme has implemented all the recommendations in the said report.

For instance, SSNIT has seen an increase in contribution rate in accordance with a funding policy.

The report revealed that the contribution rate to pay the benefits over the next 75 years and to accumulate assets representing three years of total expenditure is 22%, double the current 11% after NHIS deductions (2.5%). It said cash flow analysis suggests a short-term increase is needed to avoid relying on investment income for benefits.

The report recommended the need to increase the active contributor base and the Trust is doing by embarking the Self Employed Enrollment Drive (SEED).

It also recommended a decrease of the indebtedness to the Scheme, of which the SSNIT has been conducting massive inspections, retrieval of arrears and the prosecutions of the defaulting employers.

Meanwhile SSNIT is the largest single institutional investor on the Ghana Stock Exchange (GSE) and the main driver of the development of the Capital Market in Ghana.

The Trust holds a significant number of shares listed on the GSE with twenty-two (22) out of the thirty-seven (37) listed companies and ninety five (95) percent of companies in which SSNIT has interest continue to pay impressive dividends as evidence of the viability of the Scheme. The said companies include but not limited to

In addition to the stock market investments, the Trust has investments in fifty-four (54) unlisted companies including banks, non-bank financial institutions and insurance, pharmaceuticals, food and beverage, mining and agriculture.

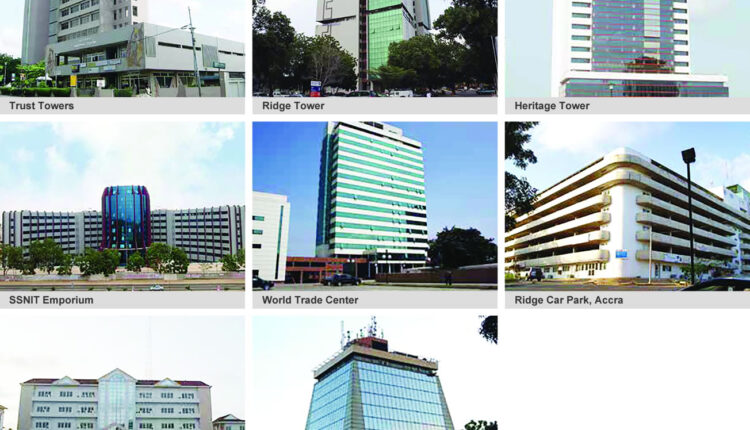

It has also invested in the sectors of energy as in power, oil, and gas. In the real estate sector, SSNIT has investments in residential, commercial, community markets and malls, multi-storey car parks, property management and industrial estate.

Comments are closed.