The National Pensions Regulatory Authority, NPRA, says the impact of COVID-19 on the pensions industry globally is a reminder to developing countries such as Ghana to introduce and implement long-term sustainable plans for the aged.

According to the NPRA, most pension funds have suffered a setback because some of the major financial assets where these pension funds were invested witnessed a huge dip in returns due to uncertainties caused by the pandemic.

Speaking on behalf of the CEO of the National Pensions Regulatory Authority on the sidelines of the launch of the Pempamsie Fund, a third tier pension scheme for the Civil and Local Government Staff Association of Ghana, (CLOGSAG), Assistant Manager, Corporate Services, Roland Avenyo-Addico, urged industry players to employ key strategies to protect the pension contributions of workers.

“The authorities anticipate that successful implementation of personal pension scheme can reduce poverty levels in the country. As policy makers and regulators, our objective is to ensure efficiency, effectiveness to drive the scheme. The authority continues to leverage technology including mobile money platforms to support the expansion of pensions coverage into the informal sector and transform ways of improving financial inclusion,” he said.

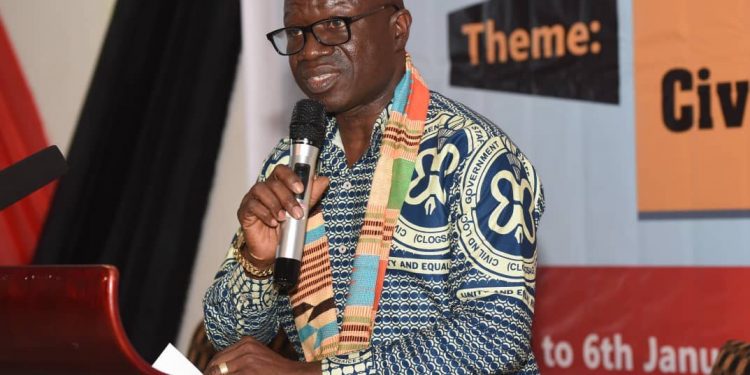

Dr. Evans Dzikum, President of Civil and Local Government Staff Association, Ghana, urged government workers to plan well for their pensions because they will need more resources to live on during retirement.

“Looking at the present pension scheme, majority of workers would be entitled to only one quarter of their current incomes during retirement. Now is the time to save into the Fund to secure the future and have a better pension life,” he said.

Comments are closed.